European equities: Regained momentum amid a structural theme reshaping the landscape

Summary

Share

Marketing communication

Key takeaways

- European equities are attracting strong investor interest, supported by stabilising economic activity, attractive valuations and a more constructive policy backdrop.

- Within this context, Europe’s pursuit of strategic autonomy is emerging as a significant structural theme shaping opportunities across defence, energy, technology and critical industries.

- ETFs provide an efficient and transparent way to capture these opportunities.1

Europe regains attention

European equities have returned to focus this year as investors reassess the region’s fundamentals. After a prolonged period of external shocks and subdued activity, there are now clearer signs that activity in Europe is bottoming out. This shift reflects easing inflation, the normalisation of policy rates and early signs of improving momentum. At the same time, European equity valuations remain at a notable discount to those in the United States (see risk premium chart below), prompting investors to take a fresh look at the asset class.

*This measure captures differential between current earning yield level and Treasury bond yield (in local currency and vs 12M German bund yield and 12M US treasury yield). Sources: Amundi, Bloomberg, data as at 29/10/2025. Past market trends are not a reliable indicator of future ones. For illustrative purposes only, may change without prior notice.

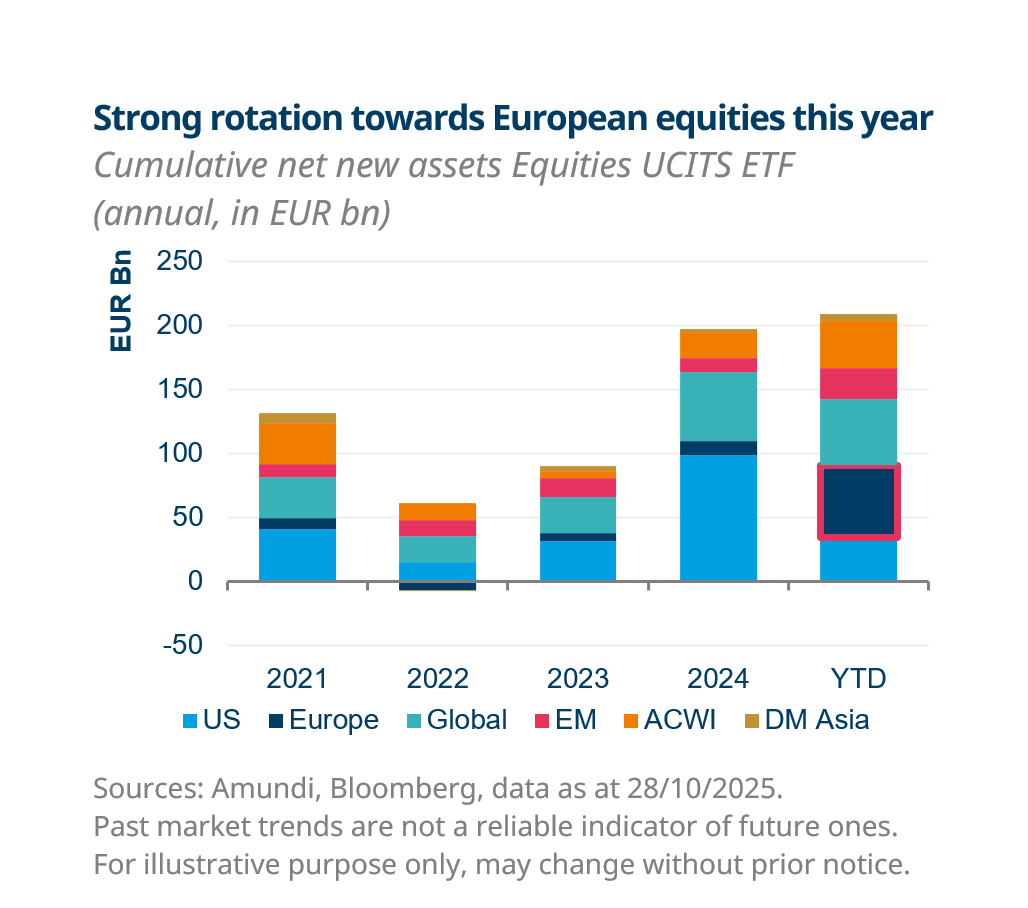

Flows data reflect the shift in sentiment. Demand for the asset class has strengthened (see chart below), indicating that investors are increasingly re-engaging with the region as valuations improve and the economic backdrop shows signs of stabilising. European equities have also been the most favoured asset class year-to-date in the UCITS ETF market, underscoring the renewed appetite for the region.2

Policy developments have also played a role. Germany’s unprecedented commitment to increasing investment and defence spending earlier this year has been a significant turning point, and could help to offset some of the negative effects associated with tariff uncertainty.

More broadly, fiscal spending across Europe, if efficiently deployed, could offer further support to EU GDP growth, reinforcing the region’s improving macroeconomic backdrop. Alongside this, markets are anticipating stronger earnings per share (EPS) growth in Europe,3 reflecting the combined impact of firmer economic indicators, easing inflation and a more stable policy environment.

While uncertainties remain, valuations across many parts of the European equity market continue to imply a subdued economic scenario. Any sustained improvement in domestic demand, lower trade uncertainty or recovery in investment trends could support companies with greater exposure to intra-European activity. Against this backdrop, investors have been exploring opportunities across the region, particularly through broad exposures, with renewed interest.

Strategic autonomy: a powerful structural theme

Within the broader case for European equities, Europe’s pursuit of strategic autonomy has emerged as a defining structural theme. The concept first took shape in the European Union’s 2016 Global Strategy,4 initially centred on defence and security. Since then, it has broadened significantly to encompass energy, technology, semiconductors, healthcare and other essential sectors. What began as a political ambition is now becoming an economic transformation, as Europe seeks to strengthen its long-term resilience and industrial capacity.

Recent years have exposed the extent of Europe’s dependence on external suppliers for energy, advanced technology and key manufacturing inputs. The war in Ukraine highlighted the risks of relying on imported fossil fuels and foreign defence equipment. At the same time, global supply chain disruptions, from semiconductors to medical supplies, revealed vulnerabilities across manufacturing and healthcare. These shocks have coincided with a wider trend towards global protectionism, prompting Europe to reassess how it safeguards its strategic and economic interests.

Strategic autonomy is not about withdrawing from global trade or collaboration. Rather, it reflects the need for Europe to ensure it can respond effectively to crises, support critical industries and sustain competitiveness in a more fragmented world. It is grounded in the principle of resilience: building the technological, industrial and energy capabilities required to act independently when circumstances demand it.

Europe’s policy response

To support this shift, the European Union and its member states have launched an ambitious policy framework aimed at strengthening resilience across multiple fronts. Among the most significant initiatives are those focused on defence, energy, technology and healthcare.

In defence, the ReArm Europe and Readiness 2030 initiatives mark a major reinvestment effort, with member states planning to mobilise around €800 billion to rebuild Europe’s defence and security capabilities.5

In energy, the REPowerEU plan, supported by €300 billion in funding, seeks to accelerate the clean energy transition and reduce dependency on imported fossil fuels.6 This builds on the broader Next Generation EU programme, which channels recovery funds into green and digital infrastructure.

The EU’s Chips Act, worth €43 billion, aims to double Europe’s share of global semiconductor production by 2030 and restore control over critical technology supply chains.7

In healthcare, the EU4Health programme is investing around €5 billion between 2021 and 2027 to strengthen Europe’s preparedness for future health emergencies.8

Together, these initiatives reflect a clear policy direction aimed at strengthening Europe’s resilience, competitiveness and strategic autonomy. They are helping to reshape capital flows and investment priorities across the region.

What this means for investors

For investors, the combination of an improving economic backdrop, Europe’s renewed policy momentum and the structural shift towards strategic autonomy is creating a broad set of potential opportunities. The drive to reinforce defence, energy transition, technology and healthcare capabilities has led to multi-year public and private investment commitments.

Fiscal expansion, particularly in Germany, could support economic activity and investment, with potential knock-on effects across the region. Current market expectations for stronger EPS growth in 20263 reflect this firmer macroeconomic environment.

Strategic autonomy represents a long-term reframing of Europe’s industrial and policy landscape, underpinned by structural demand for investment in essential capabilities.

Accessing the opportunity through ETFs

For investors seeking exposure to both the broader recovery in European equities and the theme of European strategic autonomy, ETFs provide an efficient and transparent route. They offer diversified9 access to companies aligned with Europe’s evolving industrial and policy priorities, whether through broad European equity indices such as the Stoxx Europe 600, or through targeted sector and thematic strategies linked to areas such as defence and European strategic autonomy.

1. Investment involves risks. For more information, please refer to the Risk section at the end of the document.

2. Source: Amundi, Bloomberg as at 20 November 2025

3. 11.4% YoY – data based on Bloomberg estimates as at 31/10/2025 for the Stoxx Europe 600

4. European External Action Service, Shared Vision, Common Action: A Stronger Europe — A Global Strategy for the European Union’s Foreign and Security Policy, June 2016. Available at: https://eeas.europa.eu/archives/docs/top_stories/pdf/eugs_review_web.pdf

5. Source: European commission. https://commission.Europa.eu/topics/defence/future-European-defence_en. SAFE refers to Security Action for Europe

6. Source: https://commission.europa.eu/topics/energy/repowereu_en

7. Source: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/europe-fit-digital-age/european-chips-act_en

8. Source: https://commission.europa.eu/funding-tenders/find-funding/eu-funding-programmes/eu4health_en

9. Diversification does not guarantee a profit or protect against a loss.

KNOWING YOUR RISK

It is important for potential investors to evaluate the risks described below and in the fund’s Key Information Document (“KID”) and prospectus available on our websites www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index securities. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index securities of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index securities. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – ETFs can select a large portion of their assets in a particular issuer, industry, stocks or type of bonds, country or region for their portfolio. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks. This can mean both higher volatility and a greater risk of loss.

IMPORTANT INFORMATION

This material is solely for the attention of professional and eligible counterparties, as defined in Directive MIF 2014/65/UE of the European Parliament (where relevant, as implemented into UK law) acting solely and exclusively on their own account. It is not directed at retail clients. In Switzerland, it is solely for the attention of qualified investors within the meaning of Article 10 paragraph 3 a), b), c) and d) of the Federal Act on Collective Investment Scheme of June 23, 2006.

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as defined in the prospectus of the Funds or in the legal mentions section on www.amundi.com and www.amundietf.com. The Funds have not been registered in the United States under the Investment Company Act of 1940 and units/shares of the Funds are not registered in the United States under the Securities Act of 1933.

This document is of a commercial nature. The funds described in this document (the “Funds”) may not be available to all investors and may not be registered for public distribution with the relevant authorities in all countries. It is each investor’s responsibility to ascertain that they are authorised to subscribe, or invest into this product. Prior to investing in the product, investors should seek independent financial, tax, accounting and legal advice.

This is a promotional and non-contractual information which should not be regarded as an investment advice or an investment recommendation, a solicitation of an investment, an offer or a purchase, from Amundi Asset Management (“Amundi”) nor any of its subsidiaries.

The Funds are Amundi UCITS ETFs and Amundi ETF designates the ETF business of Amundi.

Amundi UCITS ETFs are passively-managed index-tracking funds. The Funds are French, Luxembourg or Irish open ended mutual investment funds respectively approved by the French Autorité des Marchés Financiers, the Luxembourg Commission de Surveillance du Secteur Financier or the Central Bank of Ireland, and authorised for marketing of their units or shares in various European countries (the Marketing Countries) pursuant to the article 93 of the 2009/65/EC Directive.

The Funds can be French Fonds Communs de Placement (FCPs) and also be sub-funds of the following umbrella structures:

- Amundi Index Solutions, Luxembourg SICAV, RCS B206810, located 5, allée Scheffer, L-2520, managed by Amundi Luxembourg S.A.

- Amundi ETF ICAV: open-ended umbrella Irish collective asset-management vehicle established under the laws of Ireland and authorized for public distribution by the Central Bank of Ireland. The management company of the Fund is Amundi Ireland Limited, 1 George’s Quay Plaza, George’s Quay, Dublin 2, D02 V002, Ireland. Amundi Ireland Limited is authorised and regulated by the Central Bank of Ireland

- Multi Units France, French SICAV, RCS 441 298 163, located 91-93, boulevard Pasteur, 75015 Paris, France and managed by Amundi Asset Management located 91-93, boulevard Pasteur, 75015 Paris

- Multi Units Luxembourg, RCS B115129, Luxembourg SICAV located 9, rue de Bitbourg, L-1273 Luxembourg, managed by Amundi Luxembourg S.A. located 5, allée Scheffer, L-2520 Luxembourg

Before any subscriptions, the potential investor must read the offering documents (KIID and prospectus) of the Funds. The prospectus in French for French UCITS ETFs, and in English for Luxembourg UCITS ETFs and Irish UCITS ETFs, and the KIID in the local languages of the Marketing Countries are available free of charge on www.amundi.com, www.amundi.ie or www.amundietf.com. They are also available from the headquarters of Amundi Luxembourg S.A. (as the management company of Amundi Index Solutions and Multi Units Luxembourg), or the headquarters of Amundi Asset Management (as the management company of Amundi ETF French FCPsand Multi Units France), or at the headquarters of Amundi Ireland Limited (as the management company of Amundi ETF ICAV). For more information related to the stocks exchanges where the ETF is listed please refer to the fund’s webpage on amundietf.com.

Investment in a fund carries a substantial degree of risk (i.e. risks are detailed in the KIID and prospectus). Past Performance does not predict future returns. Investment return and the principal value of an investment in funds or other investment product may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.

It is the investor’s responsibility to make sure his/her investment is in compliance with the applicable laws she/he depends on, and to check if this investment is matching his/her investment objective with his/her patrimonial situation (including tax aspects).

Please note that the management companies of the Funds may de-notify arrangements made for marketing as regards units/shares of the Fund in a Member State of the EU or the UK in respect of which it has made a notification.

A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page athttps://about.amundi.com/legal-documentation with respect to Amundi ETFs.

This document was not reviewed, stamped or approved by any financial authority.

This document is not intended for and no reliance can be placed on this document by persons falling outside of these categories in the below mentioned jurisdictions. In jurisdictions other than those specified below, this document is for the sole use of the professional clients and intermediaries to whom it is addressed. It is not to be distributed to the public or to other third parties and the use of the information provided by anyone other than the addressee is not authorised.

This material is based on sources that Amundi and/or any of her subsidiaries consider to be reliable at the time of publication. Data, opinions and analysis may be changed without notice. Amundi and/or any of her subsidiaries accept no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi and/or any of her subsidiaries can in no way be held responsible for any decision or investment made on the basis of information contained in this material.

Updated composition of the product’s investment portfolio is available on www.amundietf.com. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them.

Indices and the related trademarks used in this document are the intellectual property of index sponsors and/or its licensors. The indices are used under license from index sponsors. The Funds based on the indices are in no way sponsored, endorsed, sold or promoted by index sponsors and/or its licensors and neither index sponsors nor its licensors shall have any liability with respect thereto. The indices referred to herein (the “Index” or the “Indices”) are neither sponsored, approved or sold by Amundi nor any of its subsidiaries. Neither Amundi nor any of its subsidiaries shall assume any responsibility in this respect.

AMUNDI PHYSICAL GOLD ETC (the “ETC”) is a series of debt securities governed by Irish Law and issued by Amundi Physical Metals plc, a dedicated Irish vehicle (the “Issuer”). The Base Prospectus, and supplement to the Base Prospectus, of the ETC has been approved by the Central Bank of Ireland (the “Central Bank”), as competent authority under the Prospectus Directive. Pursuant to the Directive Prospective Regulation, the ETC is described in a Key Information Document (KID), final terms and Base Prospectus (hereafter the Legal Documentation). The ETC KID must be made available to potential subscribers prior to subscription. The Legal Documentation can be obtained from Amundi on request. The distribution of this document and the offering or sale of the ETC Securities in certain jurisdictions may be restricted by law. For a description of certain restrictions on the distribution of this document, please refer to the Base Prospectus. The investors are exposed to the creditworthiness of the Issuer.

In EEA Member States, the content of this document is approved by Amundi for use with Professional Clients (as defined in EU Directive 2004/39/EC) only and shall not be distributed to the public.

Information reputed exact as of the date mentioned above.

Reproduction prohibited without the written consent of Amundi.

UNITED KINGDOM

Marketing Communication. For Professional Clients only. In the United Kingdom (the “UK”), this marketing communication is being issued by Amundi (UK) Limited (“Amundi UK”), 77 Coleman Street, London EC2R 5BJ, UK. Amundi UK is authorised and regulated by the Financial Conduct Authority (“FCA”) and entered on the FCA’s Financial Services Register under number 114503. This may be checked at https://register.fca.org.uk/ and further information of its authorisation is available on request. This marketing communication is approved by Amundi UK only for use with Professional Clients (as defined in the FCA’s Handbook of Rules and Guidance, the “FCA Rules”)) and shall not be distributed to the public, relied on or acted upon by any other persons for any purposes whatsoever. Past performance is not a guarantee or indication of future results.

Each fund and/or sub-fund(s) (if any) that is referred to in this marketing communication (each, a “Fund”) is/are (a) recognised scheme(s) under the FCA’s Overseas Fund Regime.

UK investors should consider getting financial advice before deciding to invest in a Fund, see the prospectus of the Fund for more information and be aware that: (i) each Fund is authorised overseas, but not in the UK; (ii) the protections afforded by and the rules of, the UK regulatory system (as defined in the FCA Rules), generally will not apply to an investment in a Fund, including the Financial Ombudsman Service (“FOS”), and as such UK investors may not be able to seek redress from the FOS for a complaint related to a Fund, its operator and/or its depositary; and (iii) compensation for any claims for losses suffered as a result of the operator and/or the depositary of a Fund being unable to meet its/their liabilities to UK investors, are unlikely to be covered under the UK Financial Services Compensation Scheme. Each Fund is based overseas and is not subject to UK sustainable investment labelling and disclosure requirements.

The Central Bank has notified the FCA of its approval of the Base Prospectus. Potential investors in the UK should be aware that none of the protections afforded by the UK regulatory system (as defined in the FCA Rules) will apply to an investment in the ETC and that compensation will not be available under the UK Financial Services Compensation Scheme.

Amundi Asset Management

French “Société par Actions Simplifiée” - SAS with a share capital of €1 143 615 555

Portfolio management company approved by the French Financial Markets Authority (Autorité des Marchés Financiers) under no.GP 04000036

Head office: 91-93, boulevard Pasteur, 75015 Paris - France

Postal address: 91, boulevard Pasteur, CS 21564, 75730 Paris Cedex 15 - France

Tel : +33 (0)1 76 33 30 30

Siren no. 437 574 452 RCS Paris