2024 Mid-Year Outlook: ETF Implementation

Summary

Share

Harnessing multi-speed growth and divergent dynamics in H2

Following last year's global inflation surge and the subsequent tightening of central bank monetary policies, the economic outlook is looking increasingly fragmented.

The US economy is experiencing a slowdown, while the European Union is gradually recovering. China is undergoing a controlled, policy-supported slowdown whereas countries like India, are seeing strong growth. Inflation remains more persistent than expected across the board, but gradually normalising, paving the way for further central bank rate cuts.

In this unusual environment, with some markets priced for perfection, despite uncertainty stemming from geopolitical risks and the upcoming US elections, investors may wish to consider an asset allocation that offers the potential to withstand different scenarios.

To this end, we favour high-quality equities, a positive duration stance and commodities as a way to manage inflation risk.

Equities: Finding catch-up opportunities as equities pause for breath

Barring a recession, which in our view is unlikely to materialise, we believe equities will remain attractive.

Earnings growth in 2024 is expected to be solid, with earnings per share (EPS) growth expected to reach +8% in the US, and +2% in Europe, recovering from the trough in the first quarter of the year.1

So, given this positive earnings outlook, where can the market go from here?

While the Fed put2 remains supportive, equity indices are already pricing in an improving economic outlook. We also need to consider that uncertainty surrounding the outcome of the US presidential election is likely to precipitate increased market volatility as the November vote draws closer. Against this backdrop, we expect equity markets to remain range-bound over the coming months, making regional choices less compelling overall. That said, we believe there are still pockets of opportunities to be found.

Embrace global Equities as a potential source of consistent, long-term returns

Today's challenging economic conditions, characterized by stretched valuations that leave investors vulnerable, with little margin for error, have strengthened our commitment to global equities as an essential part of any investment portfolio.

Investing in global equities offers geographic and sectoral diversification3, along with the potential for higher long-term returns, enabling investors to benefit from the equity risk premium. ETFs provide a simple and cost-efficient means of achieving global equities exposure.

ETFs tracking MSCI World indices, for instance, provide exposure to over 1,600 large and mid-cap stocks across 23 developed markets. And for investors seeking an even more comprehensive level of diversification4, there are ETFs tracking All Country World indices, which offer highly-diversified exposure to large and mid-cap stocks in both developed and emerging markets. The IMF estimates 4.0% GDP growth YoY on average for EM economies over the next five years, twice as much as the forecast for DM over the same period (1.7% YoY).5

ETF implementation ideas

Diversify6 with US equal weight

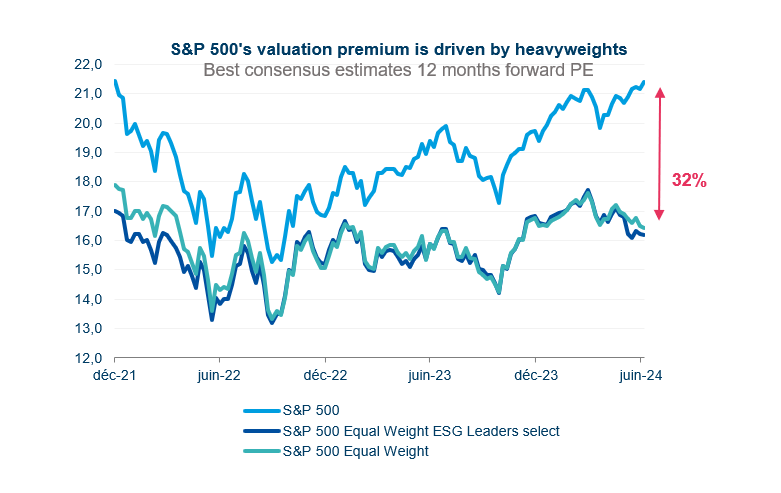

We have concerns about excessive valuations in the US and believe the strong rally of the Magnificent 77 in the US, which have accounted for over 60% of the S&P 500′s total performance in the year to date8, could fade, along with their contribution to earnings.

Source: Bloomberg, Amundi. As at 05/07/2024. Past performance is not a reliable indicator of future performance.

In anticipation of a more balanced earnings profile, now may therefore be a good time to consider an equal-weight approach to US equities, which offers greater diversification9 by avoiding concentration in the largest companies.

ETF implementation ideas

Embrace undervalued European Equities, including small caps

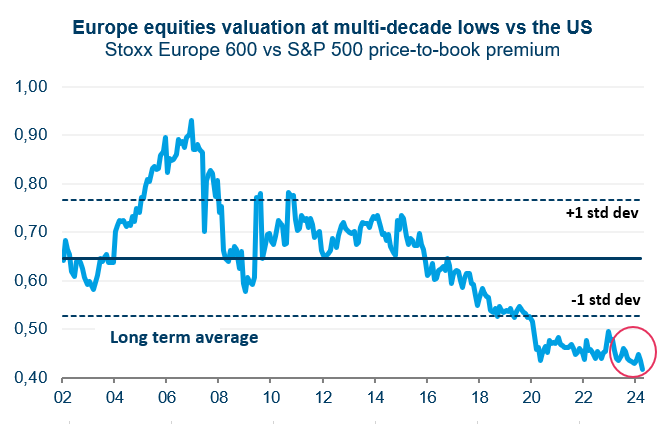

Confounding many observers, European equities’ performance has been strong over the past year,10 aided by a number of factors, including a bottoming out of economic activity, anticipations of lower policy rates and attractive valuations.

Despite this, there is plenty of room for a catchup with US equities, to which they are trading at a significant valuation discount.

Source: Bloomberg, Amundi as at 31/05/2024. Past performance is not a reliable indicator of future performance.

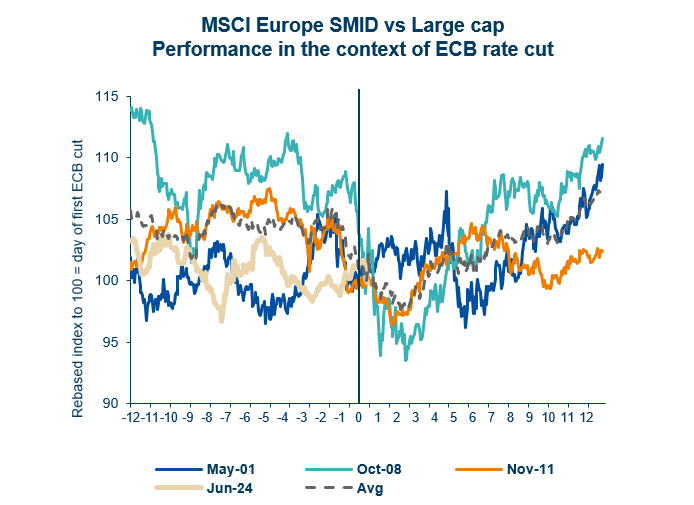

Within the asset class, we see the potential for European small-cap stocks to outperform in the second half of the year, supported by stronger earnings and a 20-year low valuation gap vs large caps.

Source: Amundi Investment Institute, Refinitiv. Data is as of 10 June 2024. Past performance is not a reliable indicator of future performance.

It is also worth noting that small caps have historically outperformed large-caps following the first ECB rate cut after a hiking cycle11.

ETF implementation ideas

Unlock growth potential with Emerging Markets

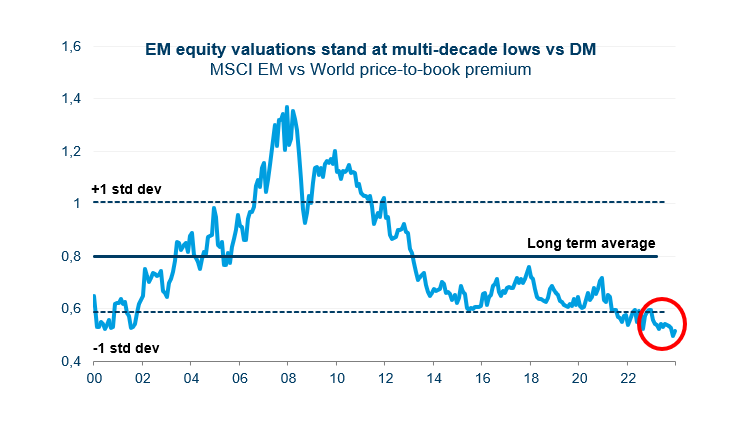

Emerging Markets (EMs) are playing a crucial role in driving the global economic recovery in 2024 due to their resilience, adaptability and sound policy frameworks.

We are positive on equities within the region, whose valuations and performance stand at multi-decade lows versus developed markets.

This, along with a weaker US dollar, should prove supportive to the performance of EM equities in the period ahead.

Source: Amundi, Bloomberg. Data as at 30/05/2024. Past performance is not a reliable indicator of future performance.

Market expectations point to strong EPS growth for the EM bloc in 2024 (+18.1% YoY), compared to 10.1% for the S&P 500.12

Our focus includes engines of growth, such as LatAm, where valuations are still trading below their 20-year average (12 months forward PE of 8.41x vs 11.9x) and those of other EM regions13.

As regards individual country opportunities, we are positive on India, where economic growth performance continues to be well sustained. Domestic demand in the world’s fifth largest economy remains the key economic driver and we expect investments to remain robust in the second half of the year.

ETF implementation ideas

Fixed income: Manage duration in the context of falling inflation

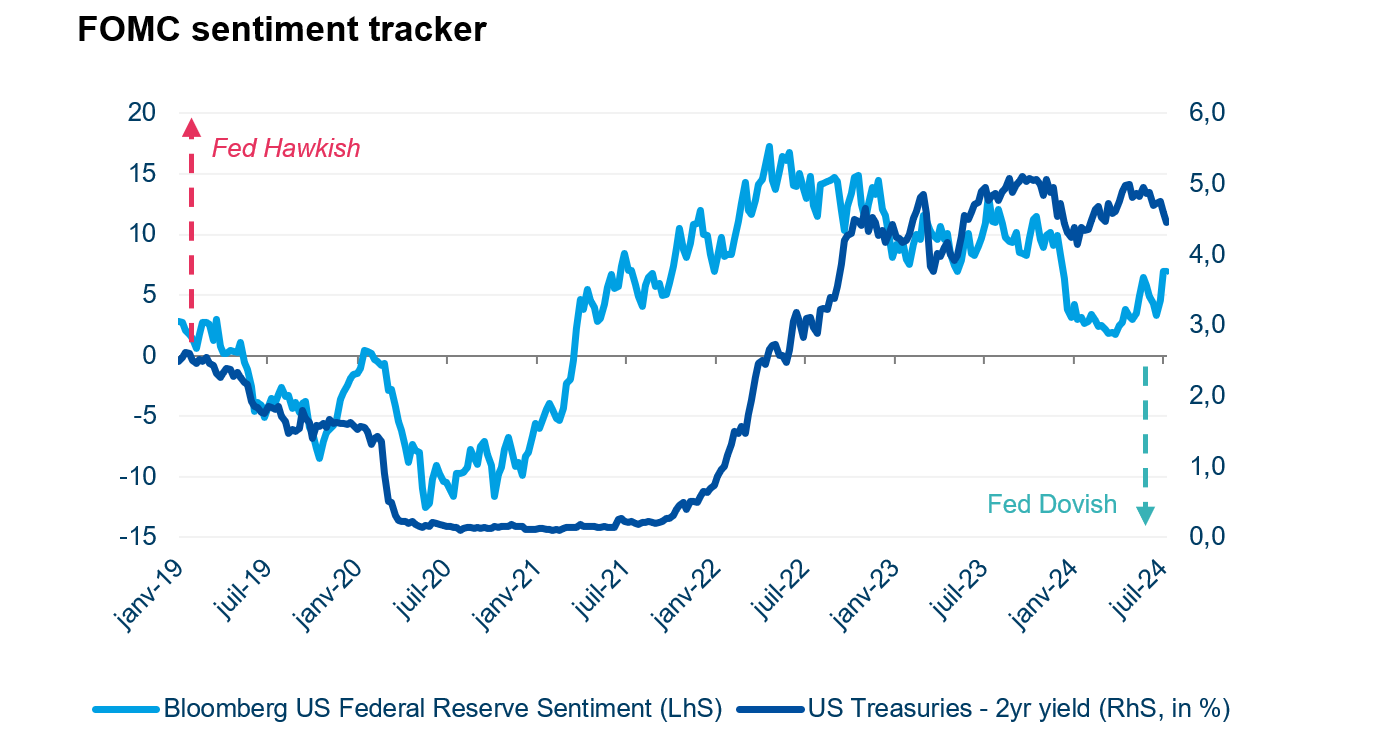

A sentiment analysis of statements from Fed officials shows that a dovish trend has emerged in 2024.

The relative ‘normalisation’ of this metric suggests that cuts to interest rates are likely to follow (though it is worth noting that the Fed continues to take a cautious approach to rate cuts and remains heavily data dependent).

Source: Bloomberg Economics. The US Federal Reserve Sentiment is underpinned by a natural language processing model algorithm trained on Bloomberg News headlines, covering about 6,200 speaking engagements by Fed officials since 2009. Data as at 8/2/2024. Past performance is not a reliable indicator of future performance.

As the ECB cut rates in June, and with potential rate cuts from the Fed and Bank of England approaching, we believe that the trading range in yields experienced over the past 18 months is over.

A positive view on duration and steepening of the curves are our main convictions in fixed income for H2.

We believe these changing dynamics are also likely to favour investment grade (IG) credit, while we remain committed to the role that fixed income could play in responsible portfolios.

Government bonds – calibrate duration

Recent data shows that the US economy is cooling with the services sector slowing and labour market normalising. The impact of monetary tightening will likely be felt in late 2024 and early 2025. Core inflation14 rose by 0.1% month-on-month in June, the smallest monthly increase in 2024 since January. The Fed remains cautious on inflation but we still believe there could be two rate cuts in the second half of the year.

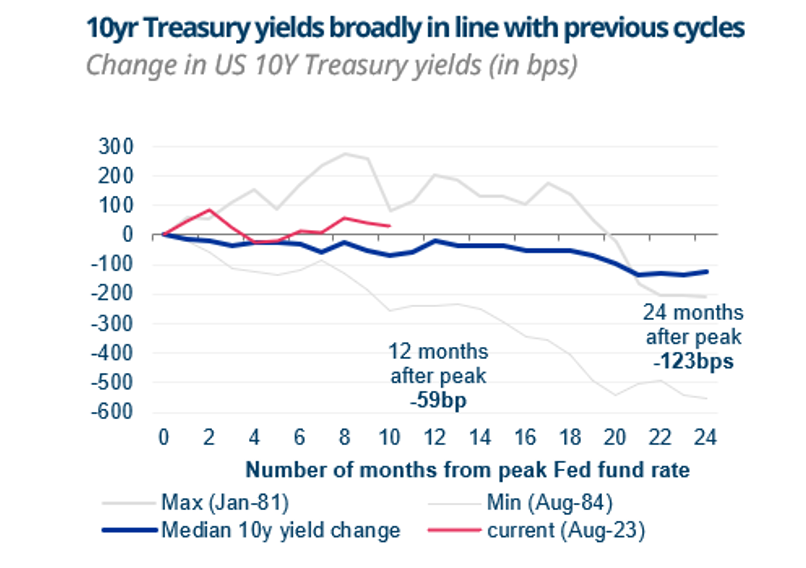

Given this backdrop, we remain agile in our allocation to US Treasuries and are positive on duration, seeing opportunities at both the shorter and longer end of the curve.

On the short end, short-dated bonds should decline faster in the easing cycle. On the other side, adding duration could be key to locking in higher levels as longer-dated bonds are the biggest beneficiary of falling rates. Investors should nevertheless remain vigilant. With the election approaching, the market could reassess fiscal risk and demand an additional yield on the long end of the curve.

Source: Bloomberg, Amundi as at 11/07/2024. Past performance is not a reliable indicator of future performance.

When it comes to Europe, we are slightly positive on duration, and favouring all maturity exposures could be an interesting path for investors. For those looking for a responsible investment solutions, we offer a range ETFs that provide exposure to green European government debt and can be aligned with your investment needs.

Green bonds could play a role in addressing the ‘green’ financing gap, which is estimated to run into trillions of dollars15. Investors could gain exposure to green bonds through a Green-Tilted ETF that delivers a similar duration to the parent index on top of a greater exposure to green-project financing.

ETF implementation ideas

Credit: It’s all about quality

We take a positive stance on credit, mostly in the IG space, with the preference for European valuations. We remain cautious on lower rated names in the high yield (HY) space.

Current valuations see spreads looking tight by historical standards in absolute terms, but attractive in relative terms vs government bond yields.

Credit metrics are still mostly sound with a more cautious attitude towards re-leveraging in Europe. The impact of higher rates on the average cost of overall debt remains modest.

ETF implementation ideas

Responsible Investment: Focus on energy transition enablers to help reach decarbonisation goals

Despite significant progress, the transition to clean energy sources needs to continue to accelerate. To meet the International Energy Agency’s net zero by 2050 scenario, investments in energy must rise from $2.3Trn annually to $5Trn by 2030 and then $4.5Trn by 205016. This, in turn, could be seen as an opportunity for investors looking at strategies related to financing the energy transition, especially those with a focus on companies that enable this transition, in both developed and emerging markets.

Responsible investment approaches, such as Climate Transition Benchmark (CTB) strategies, have continued to gain traction. Our CTB strategies apply decarbonisation selections, weightings and exclusions all whilst aiming to track the parent index as closely as possible. We believe such strategies can provide investors with a compelling solution for choosing a responsible investment approach to core asset allocation.

ETF implementation ideas

Commodities: Consider gold as a buffer against inflation and geopolitical risk

From a long term view, fiscal profligacy among governments and rising geopolitical risks (including US/China, US/Russia) call for a renewed focus on gold. We noticed these concerns have led the markets to continue investing in gold, commonly seen as a safe haven.

In addition to this position, we also believe gold could benefit from lower rates and be used as a buffer against inflation and as a means to diversify away from dollar transactions.

Overall, gold’s low correlation to other asset class returns can potentially help to lower overall portfolio volatility. It allows for increased diversification17 and can enhance the risk-adjusted return in a multiasset portfolio.

ETF implementation ideas

Conclusion

There is no one-size-fits-all approach to investing. Asset allocation will always vary depending on investment goals, risk tolerance and time horizons. Based on our investment convictions, there are, however, investment pathways that might be worth considering.

In summary, we favour:

- US equal-weight equities

- Europe equities, including small caps

- EM equities, with focus on LatAm and Asia, in particular India

- Longer duration in core government bonds

- IG credit, in particular in euro

- Green bond-tilted exposures

- Energy transition enablers

1. Source: Amundi Investment Institute, as of 10 of June 2024.

2. The “Fed put” refers to a perception among investors that the Federal Reserve will step in to support the stock market during periods of significant market stress or downturns.

3. Diversification does not guarantee a profit or protect against a loss.

4. Diversification does not guarantee a profit or protect against a loss.

5. https://www.imf.org/en/Publications/WEO.

6. Diversification does not guarantee a profit or protect against a loss.

7. “Magnificent 7” refers to a set of seven mega-cap tech stocks: Alphabet, Amazon.com, Apple Inc, Meta Platforms, Microsoft Corp, NVIDIA and Tesla.

8. Source: Bloomberg as at 05/07/2024.

9. Diversification does not guarantee a profit or protect against a loss

10. Past performance is not a reliable indicator of future performance.

11. Past performance is not a reliable indicator of future performance.

12. Source: Bloomberg consensus estimates as at 12/07/2024.

13. Source: Bloomberg consensus estimates as at 30/06/2024.

14. Core inflation represents the changes in goods and services costs, excluding food and energy prices.

15. Source: https://www.climatepolicyinitiative.org/publication/how-big-is-the-net-zero-finance-gap/

16. Source: International Energy Agency (NZE 2021 Report)

17. Diversification does not guarantee a profit or protect against a loss.

Investment involves risks. For more information, please refer to the Risk section below.

* Ongoing charges refer to the management fees and other administrative or operating costs of the fund. For more information about all the costs of investing in the fund, please refer to its Key Investor Information Document (KIID)

** The TER is a measure that compares the ongoing costs (all taxes included) charged to a ETC against the value of that ETC’s assets. For more information about all the costs of investing in the ETC, please refer to its Key Information Document (KID). Transaction cost and commissions may occur when trading ETCs.

IInformation on Amundi’s responsible investing can be found on amundietf.com and amundi.com. The investment decision must take into account all the characteristics and objectives of the Fund, as described in the relevant Prospectus.

Marketing document - For professional clients only

KNOWING YOUR RISK

It is important for potential investors to evaluate the risks described below and in the fund’s Key Investor Information Document (“KIID”) and prospectus available on our website www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.

CREDIT WORTHINESS – The investors are exposed to the creditworthiness of the Issuer.

IMPORTANT INFORMATION

This material is solely for the attention of professional and eligible counterparties, as defined in Directive MIF 2014/65/UE of the European Parliament (where relevant, as implemented into UK law) acting solely and exclusively on their own account. It is not directed at retail clients. In Switzerland, it is solely for the attention of qualified investors within the meaning of Article 10 paragraph 3 a), b), c) and d) of the Federal Act on Collective Investment Scheme of June 23, 2006.

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as defined in the prospectus of the Funds or in the legal mentions section on www.amundi.com and www.amundietf.com. The Funds have not been registered in the United States under the Investment Company Act of 1940 and units/shares of the Funds are not registered in the United States under the Securities Act of 1933.

This document is of a commercial nature. The funds described in this document (the “Funds”) may not be available to all investors and may not be registered for public distribution with the relevant authorities in all countries. It is each investor’s responsibility to ascertain that they are authorised to subscribe, or invest into this product. Prior to investing in the product, investors should seek independent financial, tax, accounting and legal advice.

This is a promotional and non-contractual information which should not be regarded as an investment advice or an investment recommendation, a solicitation of an investment, an offer or a purchase, from Amundi Asset Management (“Amundi”) nor any of its subsidiaries.

The Funds are Amundi UCITS ETFs. The Funds can either be denominated as “Amundi ETF” or “Lyxor ETF”. Amundi ETF designates the ETF business of Amundi.

Amundi UCITS ETFs are passively-managed index-tracking funds. The Funds are French, Luxembourg or Irish open ended mutual investment funds respectively approved by the French Autorité des Marchés Financiers, the Luxembourg Commission de Surveillance du Secteur Financier or the Central Bank of Ireland, and authorised for marketing of their units or shares in various European countries (the Marketing Countries) pursuant to the article 93 of the 2009/65/EC Directive.

The Funds can be French Fonds Communs de Placement (FCPs) and also be sub-funds of the following umbrella structures:

For Amundi ETF:

- Amundi Index Solutions, Luxembourg SICAV, RCS B206810, located 5, allée Scheffer, L-2520, managed by Amundi Luxembourg S.A.

- Amundi ETF ICAV: open-ended umbrella Irish collective asset-management vehicle established under the laws of Ireland and authorized for public distribution by the Central Bank of Ireland. The management company of the Fund is Amundi Ireland Limited, 1 George’s Quay Plaza, George’s Quay, Dublin 2, D02 V002, Ireland. Amundi Ireland Limited is authorised and regulated by the Central Bank of Ireland

Before any subscriptions, the potential investor must read the offering documents (KID and prospectus) of the Funds. The prospectus in French for French UCITS ETFs, and in English for Luxembourg UCITS ETFs and Irish UCITS ETFs, and the KID in the local languages of the Marketing Countries are available free of charge on www.amundi.com, www.amundi.ie or www.amundietf.com. They are also available from the headquarters of Amundi Luxembourg S.A. (as the management company of Amundi Index Solutions), or the headquarters of Amundi Asset Management (as the management company of Amundi ETF French FCPs, Multi Units Luxembourg, Multi Units France and Lyxor Index Fund), or at the headquarters of Amundi Ireland Limited (as the management company of Amundi ETF ICAV). For more information related to the stocks exchanges where the ETF is listed please refer to the fund’s webpage on amundietf.com.

Investment in a fund carries a substantial degree of risk (i.e. risks are detailed in the KID and prospectus). Past Performance does not predict future returns. Investment return and the principal value of an investment in funds or other investment product may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.

It is the investor’s responsibility to make sure his/her investment is in compliance with the applicable laws she/he depends on, and to check if this investment is matching his/her investment objective with his/her patrimonial situation (including tax aspects).

Please note that the management companies of the Funds may de-notify arrangements made for marketing as regards units/shares of the Fund in a Member State of the EU or the UK in respect of which it has made a notification.

A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page at https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/Legal-documentation with respect to Amundi ETFs.

This document was not reviewed, stamped or approved by any financial authority.

This document is not intended for and no reliance can be placed on this document by persons falling outside of these categories in the below mentioned jurisdictions. In jurisdictions other than those specified below, this document is for the sole use of the professional clients and intermediaries to whom it is addressed. It is not to be distributed to the public or to other third parties and the use of the information provided by anyone other than the addressee is not authorised.

This material is based on sources that Amundi and/or any of her subsidiaries consider to be reliable at the time of publication. Data, opinions and analysis may be changed without notice. Amundi and/or any of her subsidiaries accept no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi and/or any of her subsidiaries can in no way be held responsible for any decision or investment made on the basis of information contained in this material.

Updated composition of the product’s investment portfolio is available on www.amundietf.com. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them.

Indices and the related trademarks used in this document are the intellectual property of index sponsors and/or its licensors. The indices are used under license from index sponsors. The Funds based on the indices are in no way sponsored, endorsed, sold or promoted by index sponsors and/or its licensors and neither index sponsors nor its licensors shall have any liability with respect thereto. The indices referred to herein (the “Index” or the “Indices”) are neither sponsored, approved or sold by Amundi nor any of its subsidiaries. Neither Amundi nor any of its subsidiaries shall assume any responsibility in this respect.

AMUNDI PHYSICAL GOLD ETC (the “ETC”) is a series of debt securities governed by Irish Law and issued by Amundi Physical Metals plc, a dedicated Irish vehicle (the “Issuer”). The Base Prospectus, and supplement to the Base Prospectus, of the ETC has been approved by the Central Bank of Ireland (the “Central Bank”), as competent authority under the Prospectus Directive. Pursuant to the Directive Prospective Regulation, the ETC is described in a Key Information Document (KID), final terms and Base Prospectus (hereafter the Legal Documentation). The ETC KID must be made available to potential subscribers prior to subscription. The Legal Documentation can be obtained from Amundi on request. The distribution of this document and the offering or sale of the ETC Securities in certain jurisdictions may be restricted by law. For a description of certain restrictions on the distribution of this document, please refer to the Base Prospectus. The investors are exposed to the creditworthiness of the Issuer.

In EEA Member States, the content of this document is approved by Amundi for use with Professional Clients (as defined in EU Directive 2004/39/EC) only and shall not be distributed to the public.

Information reputed exact as of the date mentioned above.

Reproduction prohibited without the written consent of Amundi.